It should be fairly clear by now that the husband and I adore kids. I’d describe this in detail but then wait, I already do it all the time on the blog. Pretty much every post I’ve ever written is a variation of how much I like these 5 babies.

Oh and here’s a fun fact. When the husband comes home from work every day, I make him listen to how adorable the kids have been that day. He gets the full on unedited director’s cut version of the blog (with run on sentences and everything!) and to his credit, he displays a level of enthusiasm that is remarkable considering that none of this is groundbreaking material. That’s some true love right there.

But then that’s what babies do; they take your heart and do some crazy magic to it and make you happier than you ever thought you could be.

//

Having 5 kids is borderline insane behaviour and one of the things I get asked quite a bit is how much it takes to raise so many kids in Singapore.

When it comes to money, I think we can all agree that the universal rule is: MORE IS ALWAYS BETTER. But it’s all relative, though, right? How much is enough in terms of actual dollars?

I suppose the best way to approach this is to talk about our experience of raising these babies.

Okay, let’s back it up a bit. The husband and I are from very average middle-income families, or what one might call low SES. When we graduated from NTU in 2005, we had a combined total savings amount of like $23, just enough to meet the minimum $20 withdrawal amount for emergencies. We couldn’t afford grad trips or fancy restaurants or even to take our time in finding a job.

Fast forward to 10 months after we got married, to the moment we discovered that we were having Truett. After the celebratory euphoria died down, we looked at each other and said “What have we done? How are we going to afford this baby?”At that time, we had a 4-room HDB (yay!) but still not much savings because most of it had gone into the down payment+ renovations for the house (not so yay).

To make things even more exciting, I left my job soon after Truett was born so we were effectively down to a single income.

More bills + less money = so much fun!

Those first two years after we had Truett and Kirsten back to back were some of the most difficult years we’ve gone through financially.

The husband was working hard to keep us afloat while I tried every possible way to supplement the family income on top of watching the kids at home. I started evening tuition jobs – the husband would rush home at 7pm to tag me on baby-watching duties so that I could go tutor kids on A’ Level GP. I worked on every writing/editing job that came my way, even those that offered to pay me in exposure and portfolio development. I took on every data-entry work-from-home job that was available and was glad for it. I tried property sales for a while but seeing that I had difficulty selling a sandwich to a starving person, a sales job wasn’t a great fit.

Meanwhile, we kept a very close eye on the expenses, trying to stretch every dollar and make it count.

//

This experience has taught us that raising kids can cost as much or as little as we want it to.

When Truett and Kirsten were babies, the main expenses required were for necessities like milk powder, diapers and doctor’s visits (hello, polyclinic!). With Kirsten on breastmilk for 9 months, we were looking at an additional $300-400 for both kids a month.

As for all the other costs, they were nice-to-have extras. We got tons of clothes handed down from friends. And toys? All of their favourite toys were stuff like makeshift DIY rice shakers or non-toy items like remote controls. Besides, mom is more fun than toys so we did a lot of improvised um, creative play.

How about the scariest cost of all, childcare? Right from the start, we were clear that fancy preschools were out of the question. One place that we really liked had a monthly fee of $1,080 after subsidy and while it was excellent, we considered it insane to have to shell out an extra $2,160 every month so that option got canned real quick. Finally, after visiting almost all the preschools near our home, we chanced upon a program called Flexi-Care at a school which cost $275 a month (unfortunately, that program was no longer offered after 2012, but they allowed Truett and Kirsten to finish up K2 at that price). With the CDA co-savings, it worked out to only $137.50 per kid.

This might all seem very extreme, but what I’m saying is that it can be done. We survived raising our first 3 kids on a mostly single income with some lifestyle adjustments and careful planning.

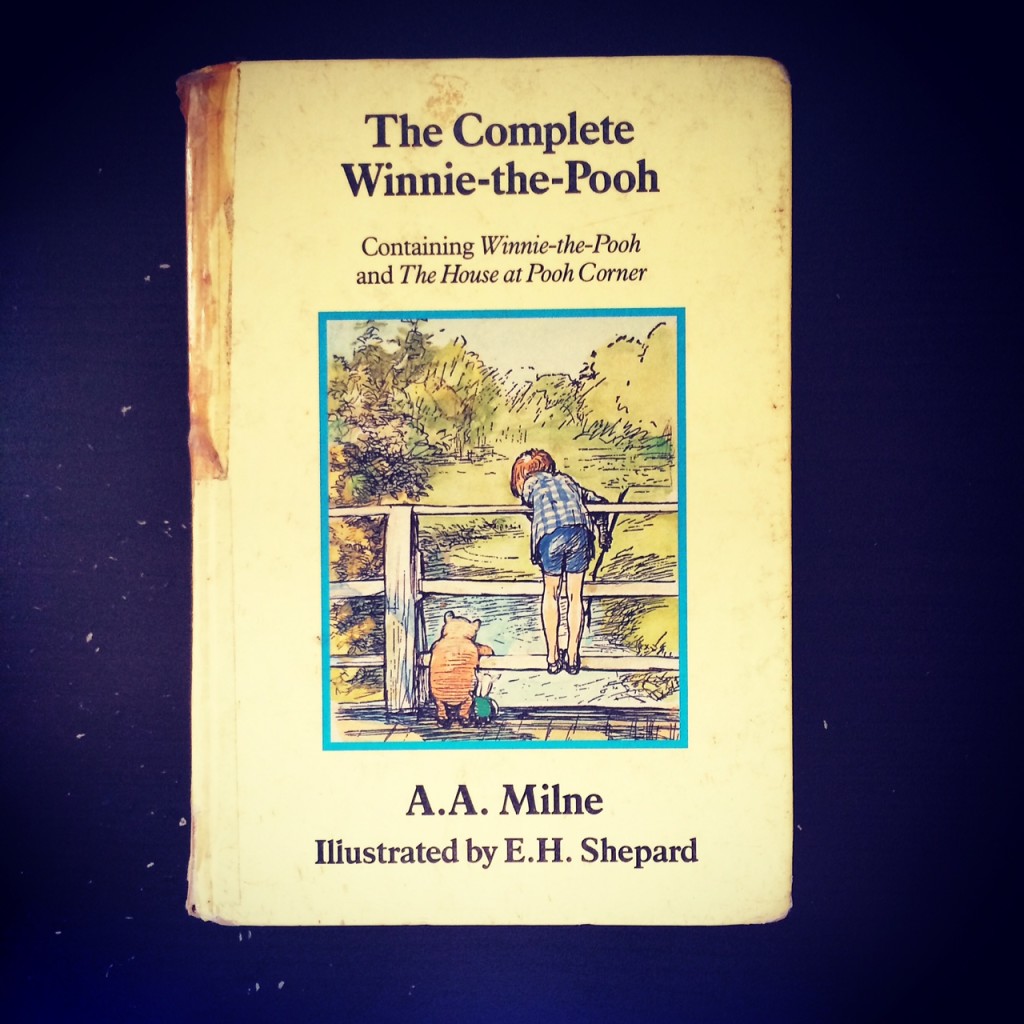

It’s since been much easier financially but we’ve kept to our philosophy of managing the kids’ expenses carefully. This includes handing down baby clothes, buying baby gear second hand, making regular trips to the library to borrow books, and selecting an affordable preschool for Finn and Theo.

Now that our budget isn’t as tight as it used to be, the one thing we splurge on is travel, which for us, is the best thing we can possibly buy with money. The time spent on adventures together as a family and the memories we get to create make it totally worth it. Although that brings me back to the point about deciding how costly raising kids can be. During the earlier years, we were happy just making memories at home and taking short trips to Sentosa for the day. When we could afford longer trips to Disney World, those were pretty rad too.

//

This seems like a good point to highlight some of the government schemes that helped us a lot with the costs of having kids. You might be familiar with Baby Bonus and the CDA, which were a huge help for us in managing the kids’ childcare fees, but there are other schemes to help with costs.

From the get go once you discover that you’re pregnant, the costs will start adding up. Pre-delivery maternity checkups can range from $70-$120 per consultation, with additional scans and tests costing upwards of $200. The actual delivery + hospitalisation costs for our kids were in the range of $2,800 (Kirsten – natural birth with epidural, KKH double bedder) to $4,500 (Truett – caesarean, Mt Alvernia double bedder).

When we first saw Truett’s delivery bill, I had a mild panic attack on top of all that pain from my c-section recovery.

It was a great help that a substantial portion of the medical bill (plus $900 for pre-delivery check ups) was claimable from Medisave, which meant that the amount required in cash was only a fraction of the total cost.

4 months of paid maternity leave is also very useful. It’s stressful enough having to adjust to the trauma of dealing with a newborn without having to worry about work stress. The leave is flexible so it can be taken all at once or spread out over the next 12 months after the child is born.

//

Looking back, would the journey have been much easier with more money? For sure. We had to make some adjustments and give up certain luxuries in favour of other more pressing needs like baby necessities, but it wasn’t like a tragedy or anything. We weren’t miserable or mopey about having to make these sacrifices.

Quite the contrary. It was such a delight waking up to Truett’s giggles and adorable baby talk at the crack of dawn every morning. We would pretend to be asleep, hoping that he’d take the hint and go back to bed, while secretly trying to peer at his squishy face because it’s the cutest thing I ever saw and I couldn’t help myself. It was the best game of peekaboo ever.

Was it hard sometimes and did we have to give up stuff along the way? Yes. Would we do it all over again? A hundred percent, yes.

Seeing how much they love it, I’ve been thinking that we should make it a regular family activity thing and I’ve compiled a list of places that would be great (and safe!) for barefoot walking in Singapore.

Seeing how much they love it, I’ve been thinking that we should make it a regular family activity thing and I’ve compiled a list of places that would be great (and safe!) for barefoot walking in Singapore.